New Delhi2 hours ago

- Copy link

The first was deadline till 15 September. So far 7.3 crore people have filed income tax.

The Income Tax Department on Monday extended the last date for filing the Income Tax Return (ITR) for 2025-26 till 16 September. The Central Board of Direct Tax (CBDT) issued a circular late at night. Earlier, there was deadline till 15 September.

So far this year, 7.3 crore people have filed income tax. There are two lakh more than last year. In 2024-25, 7.28 crore people filed ITR.

In May, the tax department extended the date of filing ITR from 31 July to 15 September. The date was extended due to technical reasons. Now it has been extended for the third time for a day.

The ITR filing tools and back-end systems also needed to change due to changes in ITR form for FY 2024-2025.

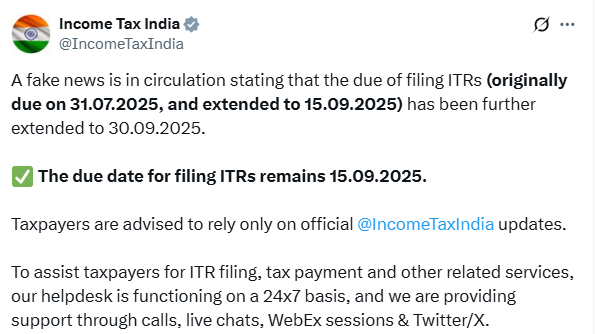

Earlier news of date increase till 30 September went viral

The Income Tax Department has also denied rumors that claimed that the deadline has been increased to 30 September.

Learn in 4 steps to file returns from Chartered Accountant (CA) Anand Jain …

1. Keep all the papers ready

- Form 16 for Salary, TDS information. For how much tax is deposited and how much is left, Form 26AS and Annual Information Statement (AIS).

- Investment proof like bank statement, interest certificate in addition to LIC, PPF, NSC. Detail of home/house loan. Rent receipt, information of capital gains.

2. Choose the correct ITR form

- ITR-1: If the income is from salary, a house and interest. Income is less than ₹ 50 lakh.

- ITR-2: If income is from salary and pension. There is more than one house or a capital gain.

- ITR-3: If income is from business or profession.

- ITR-4: Returns are being filed under the Principal Taxation Scheme.

3. online ITR filing

- Login on Income Tax website (https://incometax.gov.in).

- Put your pan and password on the e-filing portal.

- Fill the information by choosing the correct form according to income.

- Calculate tax. If you want to pay additional tax then pay online.

4. ITR Verification

- After filing the return, it is necessary to do e-verification within 30 days.

- For verification – options such as Aadhaar OTP, Net Banking, Demat account.

Late fees for not filling ITR till 16 September

- Not filing returns by 16 September will impose a fine of up to ₹ 5,000.

- After 31 December, a fine of up to ₹ 10,000 will have to be paid.

- If the income is up to ₹ 5 lakh then the maximum late fee will be ₹ 1,000.

- If tax is left, then 1% interest will have to be paid every month on the remaining amount.

Avoid giving wrong information in returns

Many taxpayers save tax by giving incorrect information about wrong deductions such as LIC, Mediclaim, House Loan Interest and donations. But in today’s time, the Income Tax Department analyzes data of return through AI. Giving incorrect information can cause notice.

,

Will be able to buy up to ₹ 10 lakh daily from UPI: You will be able to buy jewelery worth ₹ 6 lakhs; The daily limit between the first customer was ₹ 2 lakhs

UPI users will be able to pay up to 10 lakh rupees in a day from 15 September. The National Payments Corporation of India (NPCI) has increased the daily limit from Rs 2 lakh to Rs 10 lakh in several categories of Person-to-Cracha (P2M) payment. Read full news