A crowd of people outside the camp set up for money recovery in room number 428 in Nuh.

Users are investigating illegally withdrawing Rs 40 crore from the account of Gurugram based digital payment company Mobikwik in Haryana. Due to this illegal transaction, many people in Nuh, Palwal and Gurugram districts had become millionaires overnight. Now the company its money

,

On the complaint of the company in this case, the police of Sector-53 of Gurugram have arrested 5 people from Nuh and one of Palwal. All these company apps are users. The company has so far freezed around 2500 accounts. Most of these are the accounts of traders and shopkeepers. The highest amount was withdrawn from Nuh district. The company has set up a camp till 23 September in room number 428 of Nuh’s Small Secretariat. Those who have withdrawn money from the wallet have given a chance. An FIR will be lodged for non -return of the amount.

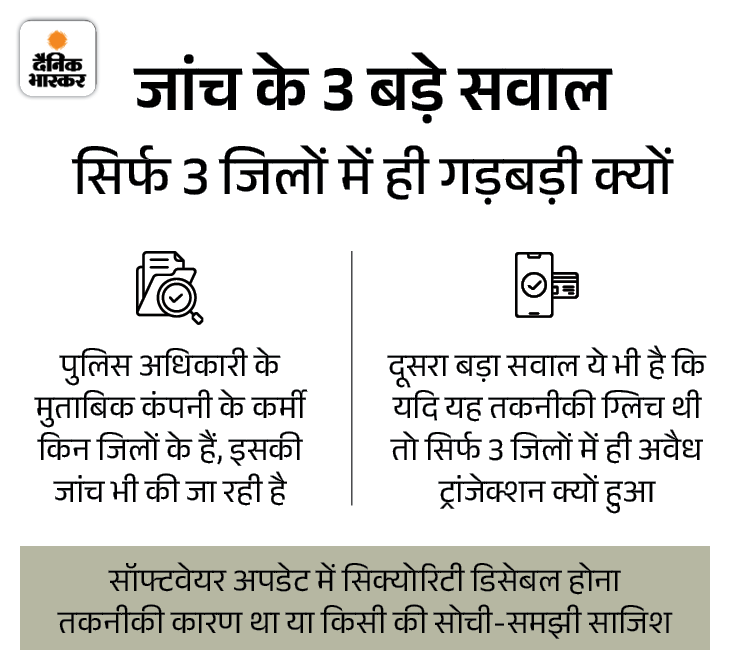

Initial investigation has revealed that there was a mistake while updating the software. Due to which the security check disabled. The company’s annual meeting is going to be held, the audit was going on with the same and the technical team was also working at night. Meanwhile, the system failed. The company’s technical team is investigating.

In Nuh, Rs 1.13 crore showed in the wallet of Medical Store Director Surendra’s Mobikwik app. Two other users showed seven and a half lakh rupees in the wallet.

The company wrote to the stock exchange-no connivance of a company personnel On this financial irregularity, the Mobikwik company has also had to clarify the situation for the Securities and Exchange Board of India (SEBI) and the National Stock Exchange. SEBI monitors and control the stock market and financial markets. In a 2 -page notice sent to SEBI, the company claimed that there is no connivance of any employee of the company in this case.

Now read the series… In one night many people became a millionaire and how the matter came under hold

3 step security bypassed during update Mobikwik released a software update, in which security was bypassed due to technical disturbances. That is, the security check disabled at the time of the app update. It opened 3 steps. Due to which the transactions were shown successful despite being unsuccessful. The money was being transferred even when a user did not have enough balance. Transaction was also succeeding even after the user puts the wrong UPI pin.

On September 11-12, 40 crores came out in about 48 hours This security check disabled took place between 11-12 September. That is, after about 48 hours, the matter came under the grip of the company. Till then 40 crore rupees were withdrawn from the company’s account. This transaction happened to UPI. The special thing is that it happened only in 3 districts of Haryana Nuh, Palwal and Gurugram.

Most of the money was withdrawn in Nuh. In the case of cyber fraud, Nuh is compared to Jamtara. District Jamtara online cybercrime of Jharkhand, especially due to “fishing” scams, infamous across the country, there are frauds through OTP, UPI, KYC.

A crowd of people outside room number 426 in Noon Small Secretariat.

On September 12, there was a disturbance in internal audit The matter came to an end in the company’s internal audit on 12 September. Especially because there was a lot of transactions in a limited area in Haryana. Shortly thereafter, the company started arrangements for detail security. A record of accounts in which transactions were taken or money was withdrawn. The glitter during the update was also cured, which was taken advantage of by some people. The company complained to the Gurugram police on 13 September.

Cyber fraud was also expected… because 30 crores came in Nuh alone Out of illegal transactions of Rs 40 crore through the Mobikwik app, there has been a transaction of Rs 30 crore in Nuh alone. The remaining 10 crore rupees went to Gurugram and Palwal districts.

A police officer associated with this investigation said that the connivance of cyber fraud or the collusion of company personnel cannot be completely denied in this case. This angle is also being investigated. A big reason behind this can also be that about 80 percent of the shopkeepers and traders of Nuh use Mobikwik app.

So far 6 arrested, 8 crore freeze in accounts According to Gurugram police spokesperson Ashok Kumar, there have been 6 arrests. These include Rehan of Rewasan village of Mewat, Waqar Yunus of village Kameda, Wakim Akram of village Marora, Mohammad Aamir and Mohammad Ansar of Kamera and Mohammad Shakeel of Utavad police station area of Palwal.

Two and a half thousand accounts have been freeze, among them 8 crores. The investigation is still going on. If any personnel of the Mobikwik company are also found involved, then action will also be taken on it. 6000 accounts of Nuh are under suspicion.

The company clarified these 7 things to the stock exchange On this financial irregularity, the situation was clarified by Mobikwik’s company secretary Ankita Sharma on September 16 at 7 points to the National Stock Exchange.

First- What is the nature of fraud Some registered merchants and users from the limited region of Haryana got together and took money from the company by fraudulently, so that they could get the wrong benefit.

What is the effect on the second company Legal action is being taken. Those who had wrongly settled. Recovery efforts are being made.

Third- when this happened It probably occurred on 11–12 September. This is an estimated time. Investigation is going on.

Fourth- Who is involved in this Some registered traders and users of the company, who were from some select areas of Haryana. It did not include any employee of the company, high officer (KMP) or internal person.

What is the fifth-orced money On the basis of preliminary information and to reduce the risk, an FIR was lodged for an amount of ₹ 40 crore. The company has withdrawn an amount of about ₹ 14 crore. The estimated total loss is ₹ 26 crore.

Sixth- fraud, lapse or arrest is reported Yes, an FIR has been lodged in the police station of Gurugram. There have also been some arrests.

Seventh- corrective steps taken after such fraud/omission The Legal Enforcement Agency (LEA) has taken active steps by imposing debit-freeze and leen mark on all bank accounts where unauthorized payments were made. Recovery is being done from customers.

Company shares were also affected On September 17, Mobikwik’s shares fell by 2.4%, which fell to ₹ 303.90. This decline in the company’s shares is a sign of concern among investors.