Mumbaia few moments ago

- copy link

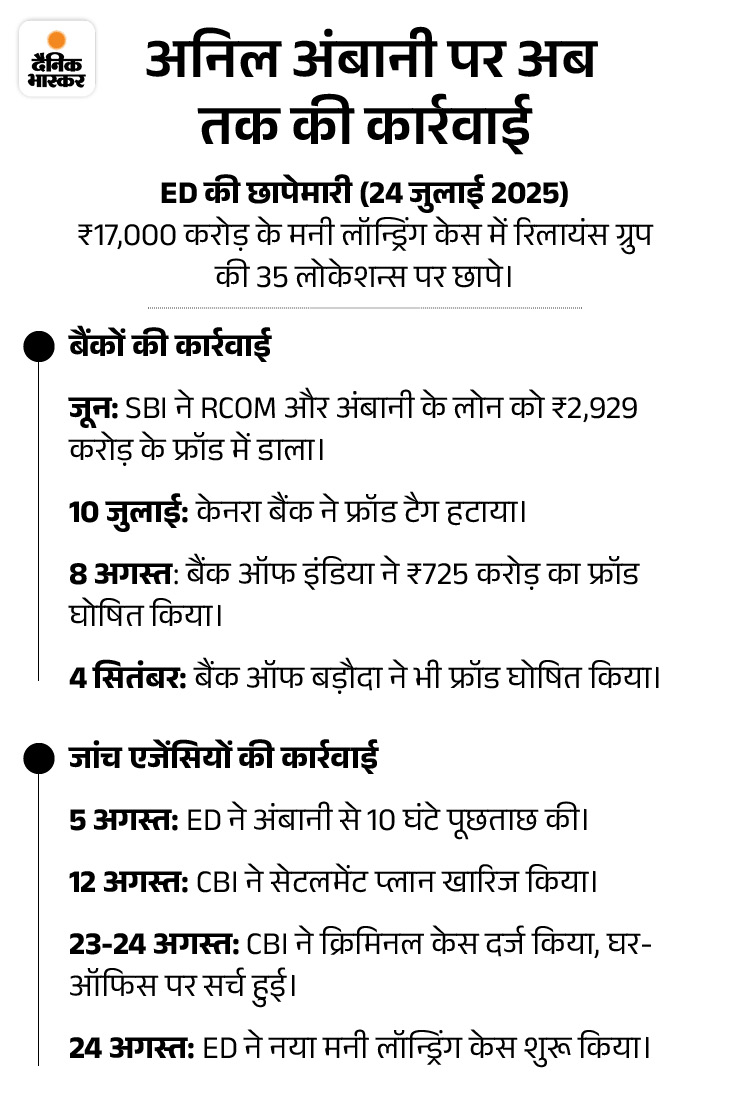

In the case, ED said that Anil Ambani and other units of Reliance Group were involved in a loan fraud case of Rs 17,000 crore.

The Enforcement Directorate (ED) has arrested Ashok Kumar Pal, Executive Director and Chief Financial Officer (CFO) of Reliance Power Limited. Pal was arrested late on October 10 in connection with the investigation into a money laundering case linked to the ADA Group.

Pal is accused of making fake bank guarantees and fake invoicing. He will be produced in the court for remand on Saturday (October 11) at 9:30 am.

ED had interrogated Anil Ambani in August

In August, ED had also called Ambani for questioning in connection with this investigation. After the ED investigation, raids were conducted at 35 places in Mumbai in August, in which 50 companies and about 25 people were involved.

On July 24, ED had raided more than 35 locations and about 50 companies associated with Anil Ambani’s Reliance Group. After this, on August 23, CBI also raided Anil Ambani’s house.

CBI had filed the charge sheet in September

Earlier, on September 18, CBI had filed two separate charge sheets against Anil Ambani and others in the Yes Bank fraud case. The allegation is that there were alleged fraudulent transactions between Ambani’s group companies and the companies of the family of former Yes Bank CEO Rana Kapoor, causing a loss of Rs 2,796 crore to the bank.

CBI had said that Rana Kapoor misused his position and diverted Yes Bank funds into Ambani’s financially weak companies – RCFL and RHFL. In return, Ambani’s companies provided low-interest loans and investments to Kapoor family companies. It was a quid pro quo (give-and-take deal).

In 2022, the Chief Vigilance Officer of Yes Bank had complained

CBI started this case in 2022 on the complaint of the Chief Vigilance Officer of Yes Bank. The chargesheet has been filed under sections of the Prevention of Corruption Act and IPC, which relate to cheating, criminal conspiracy and misuse of public property.

Apart from Anil, in the chargesheet, the CBI has named Rana Kapoor, Bindu Kapoor, Radha Kapoor, Roshni Kapoor, RCFL, RHFL, RAB Enterprises Pvt Ltd, Imagine Estate Pvt Ltd, Bliss House Pvt Ltd, Imagine Habitat Pvt Ltd, Imagine Residences Pvt Ltd and Morgan Credits Pvt Ltd under the Prevention of Chargesheet has been filed under sections of Corruption Act and IPC.

The whole matter in 3 questions and answers:

Question 1: Why did ED take action against Anil Ambani?

answer: The case pertains to loans of about Rs 3,000 crore given by Yes Bank to Anil Ambani-linked Reliance Group companies between 2017 and 2019.

Initial investigation by ED revealed that these loans were allegedly diverted to shell companies and other units of the group. The investigation also revealed that senior officials of Yes Bank may have been bribed.

Question 2: What else came to light in the ED investigation?

answer: The ED says it was a “well-thought-out and well-planned” plan, under which money was embezzled by giving false information to banks, shareholders, investors and other public institutions. The investigation found several irregularities, such as:

- Loans to weak or unverified companies.

- Use of same director and address in many companies.

- Absence of necessary documents related to the loan.

- Transferring money to fake companies.

- The process of giving new loans to repay old loans (loan evergreening).

Question 3: What is the role of CBI in this case?

answer: CBI had registered FIR in two cases. These cases relate to two separate loans given by Yes Bank to Reliance Home Finance Limited and Reliance Commercial Finance Limited. In both the cases, CBI had named former Yes Bank CEO Rana Kapoor.

After this, an official said that other agencies and institutions like National Housing Bank, SEBI, National Financial Reporting Authority and Bank of Baroda also shared information with ED. Now ED is investigating this matter.

,

Also read these news related to action against Anil Ambani…

1. ED raid on 50 companies of Anil Ambani: Case of loan fraud of ₹3000 crore, allegation of misuse of money taken from Yes Bank

2. ED action against Anil Ambani’s companies completed: Raids at 35 places in 3 days; Allegation of fraud in loan of ₹3000 crore

3. CBI raid on Anil Ambani’s premises: FIR also registered, case of loan fraud of Rs 2929 crore from SBI

4. Anil Ambani’s appeal to SBI to remove fraud tag: Lawyer said – the bank did not give Anil Ambani a chance to present his side.